Table of Content

The foreign exchange (forex) market moves at a pace where information is abundant, but clarity is scarce. With trillions traded daily, the real challenge for traders is not access to data, but the ability to distinguish actionable insights from background noise.

Trading Central’s Alpha Generation addresses this challenge by combining technical analysis, quantitative models, and expert research into a framework that highlights potential opportunities. Instead of prescribing trades, it equips traders with perspectives to approach the market more strategically and with better-prepared plans.

In this guide, we’ll explore how Alpha Generation works, its role in spotting smarter forex opportunities, and how traders can responsibly integrate it into their decision-making.

What is Trading Central Alpha Generation?

Trading Central is a widely recognised provider of market research and analytics. Its Alpha Generation platform is designed to help traders interpret market data in a more structured way. Unlike signal services that provide explicit “buy” or “sell” instructions, Alpha Generation delivers information and scenarios:

- Scenario Analysis: Identifies bullish, bearish, and neutral setups based on historical patterns and market dynamics.

- Technical Frameworks: Highlights support and resistance levels, trendlines, and key price zones.

- Quantitative Insights: Uses algorithms and historical data to spot recurring patterns that may indicate market opportunities.

- Expert Commentary: Provides context for the insights, helping traders understand why certain market behaviours may occur.

The platform is designed for use across multiple asset classes, including forex, indices, and commodities, giving traders a broader perspective on potential market dynamics.

Key Features and Benefits of Alpha Generation

Trading Central Alpha Generation provides structured insights and tools designed to help traders analyse markets responsibly and make more informed decisions, as explained below:

-

Actionable Insights

Trading Central Alpha Generation converts complex market data into structured insights that focuses on potential opportunities and market scenarios rather than providing explicit buy or sell recommendations.

By highlighting areas of interest, such as support and resistance zones, trend patterns, or volatility levels, traders can integrate these observations into their own forex trading strategies and make more informed decisions.

-

Multi-Asset Coverage

While the platform has a strong focus on forex, it also provides coverage for other asset classes, including commodities, indices, and select equities. This broader perspective allows traders to observe potential correlations between markets, for example, how changes in commodity prices might influence currency pairs.

By presenting cross-asset insights, Alpha Generation supports a more holistic view of the financial markets, helping traders evaluate opportunities with additional context, all within an educational and non-prescriptive framework.

-

Data-Driven Models

Alpha Generation in Trading Central leverages quantitative models and historical data to identify patterns that have appeared in past market behaviour. This includes AI-driven pattern recognition, trend analysis, and scenario mapping. By understanding recurring market behaviours, traders can structure their analysis and prepare for a range of possible outcomes.

Importantly, this data-driven approach emphasises informed observation over speculation.

-

Risk Awareness

Another key feature of Alpha Generation is its focus on risk awareness and management.

The platform highlights potential areas of market uncertainty, such as volatility zones, trend reversals, or price levels that could indicate higher risk exposure. This helps traders to consider appropriate measures such as stop-loss levels, position sizing, and scenario planning. The goal is to support disciplined trading practices rather than encourage risk-taking.

How to Spot Smarter Forex Opportunities?

Using the platform, traders can approach forex opportunities through several complementary lenses:

-

Technical prospective

From a technical standpoint, Alpha Generation helps traders observe price behaviour patterns and market structure. By analysing trends, momentum, and historical price levels, traders can identify areas where currencies may encounter support or resistance. This information can assist in recognising potential breakouts or periods of consolidation, enabling traders to monitor market dynamics with a more informed viewpoint.

-

Fundamental perspective

Forex markets are heavily influenced by macroeconomic and geopolitical factors.

Alpha Generation integrates insights on economic indicators, central bank policies, and geopolitical developments, providing context for potential currency movements. By understanding how events such as interest rate announcements or trade negotiations can affect specific currency pairs, traders can develop a more informed view of potential opportunities.

-

Quantitative perspective

The platform also incorporates quantitative analysis, highlighting patterns and scenarios based on historical data. By evaluating recurring behaviours, traders can assess the likelihood of certain market developments. This statistical perspective allows traders to approach opportunities with probabilistic thinking, recognising potential outcomes without assuming certainty.

Using quantitative insights responsibly helps traders strengthen their analytical process while remaining aware of inherent market risks.

-

Scenario planning

Trading Central Alpha Generation presents potential bullish, bearish, and neutral scenarios, giving traders a structured framework for considering multiple possibilities. By examining different market paths, traders can plan contingencies, manage exposure, and define risk parameters in advance.

This approach encourages a strategic mindset, helping traders prepare for varying market conditions rather than relying solely on intuition.

Using Alpha Generation in Forex

To illustrate how Alpha Generation can support informed trading decisions, consider a hypothetical EUR/USD scenario.

Suppose the European Central Bank (ECB) is scheduled to release a key policy update, and the EUR/USD pair has shown increased volatility in recent sessions. Alpha Generation may highlight:

- A resistance zone near 1.1100, where the currency pair has previously struggled to move higher.

- A support zone around 1.1000, representing a level where price has historically stabilised.

- Potential scenarios suggesting either a modest bullish move, a bearish retracement, or consolidation between these zones.

With this information, a trader can:

- Observe Market Behaviour: Monitor how the currency reacts as it approaches highlighted levels, identifying whether momentum aligns with one of the suggested scenarios.

- Prepare Risk Management Strategies: Define stop-loss thresholds and position sizes that reflect the possible range of movement indicated by the insights.

- Evaluate Multiple Scenarios: Plan for different outcomes, like bullish, bearish, or neutral, without assuming certainty about which will occur.

By combining technical, fundamental, and quantitative perspectives, traders can use Alpha Generation as a supportive tool to prepare for potential outcomes responsibly. The platform encourages structured analysis rather than reactive trading, helping traders maintain discipline in a highly dynamic market.

Best Practices for Using Alpha Generation

Trading Central Alpha Generation is designed to support informed decision-making, not to provide certainty in trading outcomes. To use the tool responsibly, traders should consider the following practices:

- Use as a Complement, not a Substitute: Insights should supplement your own research and analysis. They are informational and should not be treated as direct trading signals.

- Prioritise Risk Management: Trading always carries the risk of loss. Stop-loss orders, appropriate position sizing, and defined risk limits should be applied alongside any insights gained.

- Stay Informed: Market conditions can shift quickly due to economic announcements, central bank actions, or geopolitical events. Alpha Generation should be combined with current information to maintain relevance.

- Adopt a Structured Approach: Preparing for multiple scenarios (bullish, bearish, and neutral) helps maintain discipline and reduces the risk of emotionally driven decisions.

- Focus on Education: Treat the tool as a way to enhance understanding of market structures and behaviours, rather than as a means to achieve assured results.

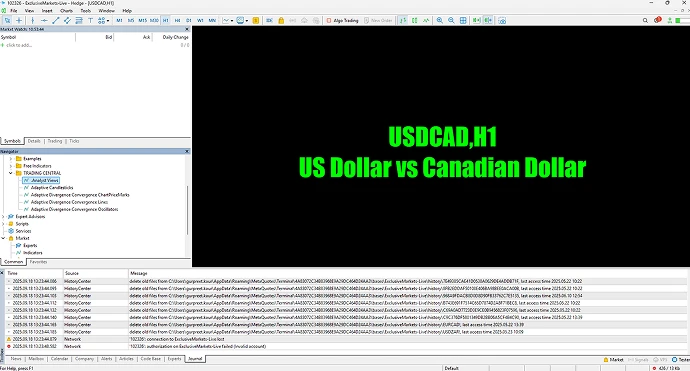

How to Use Alpha Generation with Exclusive Markets

Exclusive Markets provides seamless integration of Trading Central Alpha Generation with its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, allowing traders to access advanced insights directly within the familiar charting environment.

Here's how you can access this tool:

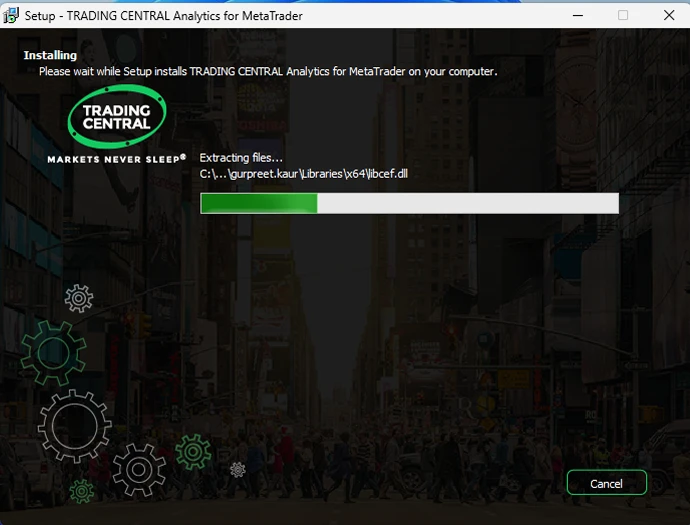

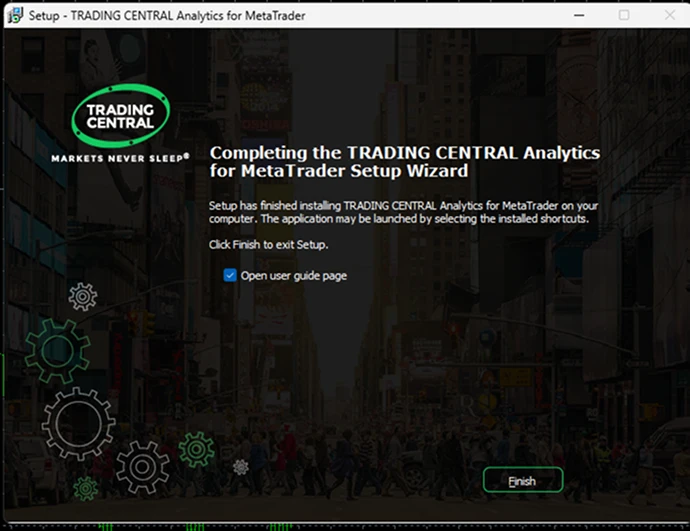

Step 1: Download and Install the Alpha Generation Plugin

Exclusive Markets offers a downloadable plug-in that integrates Trading Central’s indicators into your MT4/MT5 terminal.

After downloading:

Run the installation file.

Navigate through the setup wizard and accept the terms of agreement.

- After installation, ensure the Alpha Generation indicators appear in your MT terminal’s indicator list.

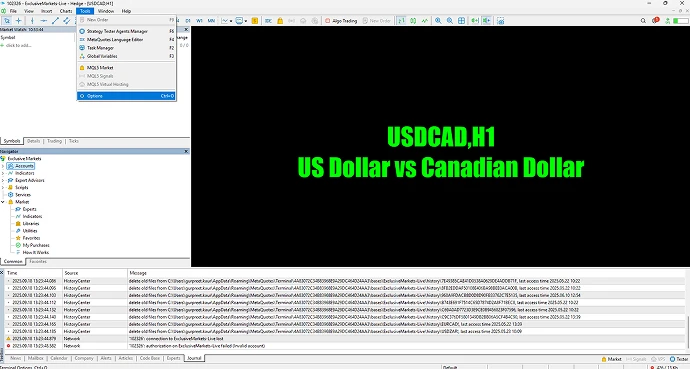

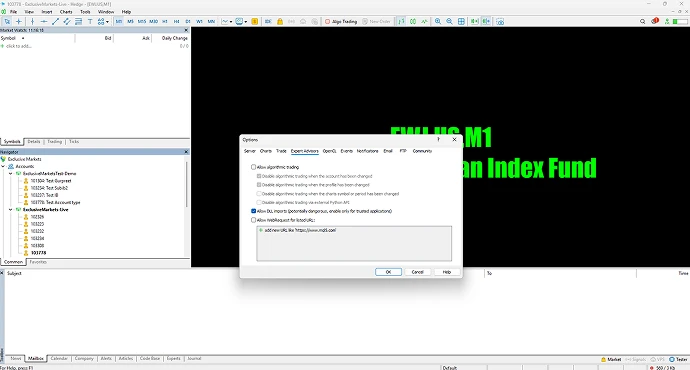

Step 2: Enable Required Settings in MetaTrader

To ensure the plugin runs correctly, make sure your terminal is configured to allow external tools:

Go to Tools → Options → Expert Advisors.

Enable the option “Allow DLL imports”.

Step 3: Launch the Indicators in Your Charts

Once installed and configured:

Locate the Trading Central indicators, such as Analyst Views, Adaptive Candlesticks, and Adaptive Divergence Convergence (ADC), in the MT4/MT5 indicators list.

Drag and drop your chosen indicator onto the relevant currency pair's chart to view insights directly on-screen.

And that’s it. Your alpha generation is ready to be used.

Step 4: Understand Each Indicator’s Role

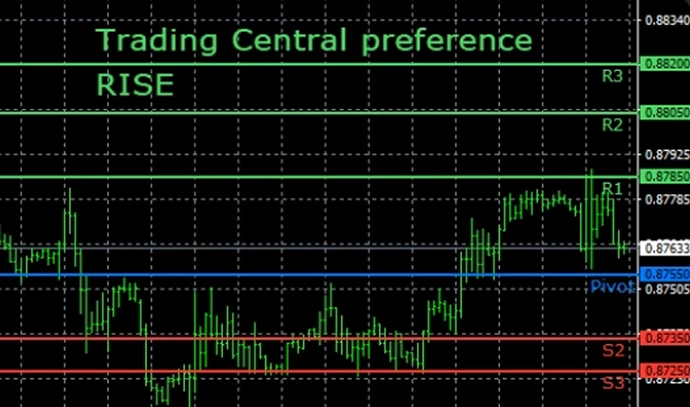

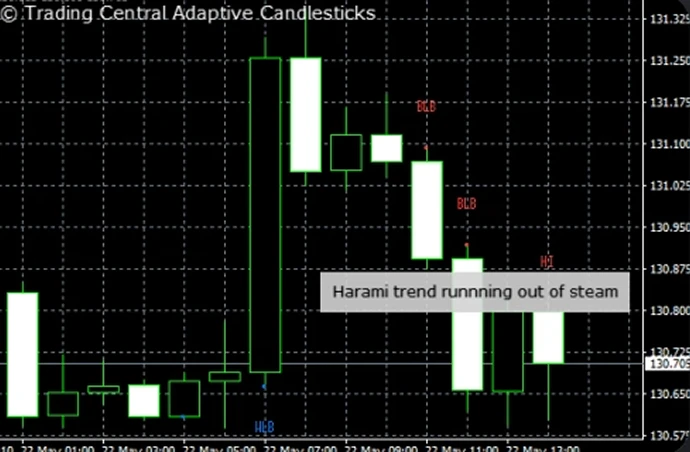

Through these indicators, traders gain structured insights:

Analyst Views: Shows preferred directional scenarios with key entry, stop-loss, and target levels overlaid on charts.

Adaptive Candlesticks: Identifies and highlights 16 key candlestick patterns to signal shifts in supply and demand.

ADC (Adaptive Divergence Convergence): Provides timely entry/exit signals along with oscillator values, which may support short-term analysis.

Conclusion

Trading Central Alpha Generation offers a structured, data-informed approach to navigating the complexities of the forex market. By integrating technical analysis, quantitative models, and expert commentary, it equips traders with perspectives that may help identify potential opportunities.

However, the tool is best used as part of a disciplined trading approach that emphasises research, preparation, and risk management. In forex trading, no insight guarantees profits, trading outcomes may vary, and losses are possible. Effective use of tools like Alpha Generation requires discipline, preparation, and awareness of risks.

Are you Ready to Explore the World of Trading?

Disclaimer: The information provided on this blog is for educational/informational purposes only and should not be considered financial/investment advice. Trading carries a high level of risk, and you should only trade with capital you can afford to lose. Past performance is not indicative of future results. We do not guarantee the accuracy or completeness of the information presented, and we disclaim all liability for any losses incurred from reliance on this content.

1570

1570 08-10-2025

08-10-2025