Table of Content

In forex trading, timing and information often make the difference between a well-planned trade and a missed opportunity. This is because currency exchange rates are influenced not only by market sentiments and technical patterns, but also by a constant stream of economic data, policy decisions, and geopolitical developments.

And, for most traders, the major challenge is not only to keep up with these events but also to understand their potential impact before the market reacts.

This is where Trading Central's Economic Calendar becomes a useful tool. It is designed to provide traders with a clear overview of scheduled economic announcements worldwide. From central bank meetings to employment reports, it helps traders stay aware of events that can trigger volatility and shape market direction.

In this guide, we will explore what Trading Central's Economic Calendar is, its significance in forex trading, and how to utilise it effectively.

What is an Economic Calendar?

By definition, an economic calendar is essentially a timetable of upcoming financial and economic events scheduled globally. These events include governmental reports, central bank announcements, and key indicators that have the potential to influence markets in one way or another.

Importance of Economic Calendar

For forex traders, the economic calendar serves as a roadmap for when crucial economic information is scheduled to be released.

Events such as GDP growth rates, inflation numbers, or employment data are not random, they are published on fixed dates and times. An economic calendar brings all of this information into one organised schedule, allowing traders to know what is coming and prepare their strategies accordingly, though outcomes are uncertain and market reactions can differ from expectations.

By comparing expectations with actual outcomes, traders can evaluate how markets might react. This is especially important because the forex market is highly sensitive to global news and macroeconomic data. Currencies reflect the strength of a nation's economy, influence central bank decisions, and shape investor sentiment.

So, when new data is released, it becomes more than just reacting to the headline, it's about anticipating how the market might respond. By keeping track of scheduled events, traders can decide whether to trade into potential volatility while also considering the heightened risks during such periods. Volatility can create both opportunities and risks, and traders should be cautious when making decisions around such events.

What is Trading Central’s Economic Calendar?

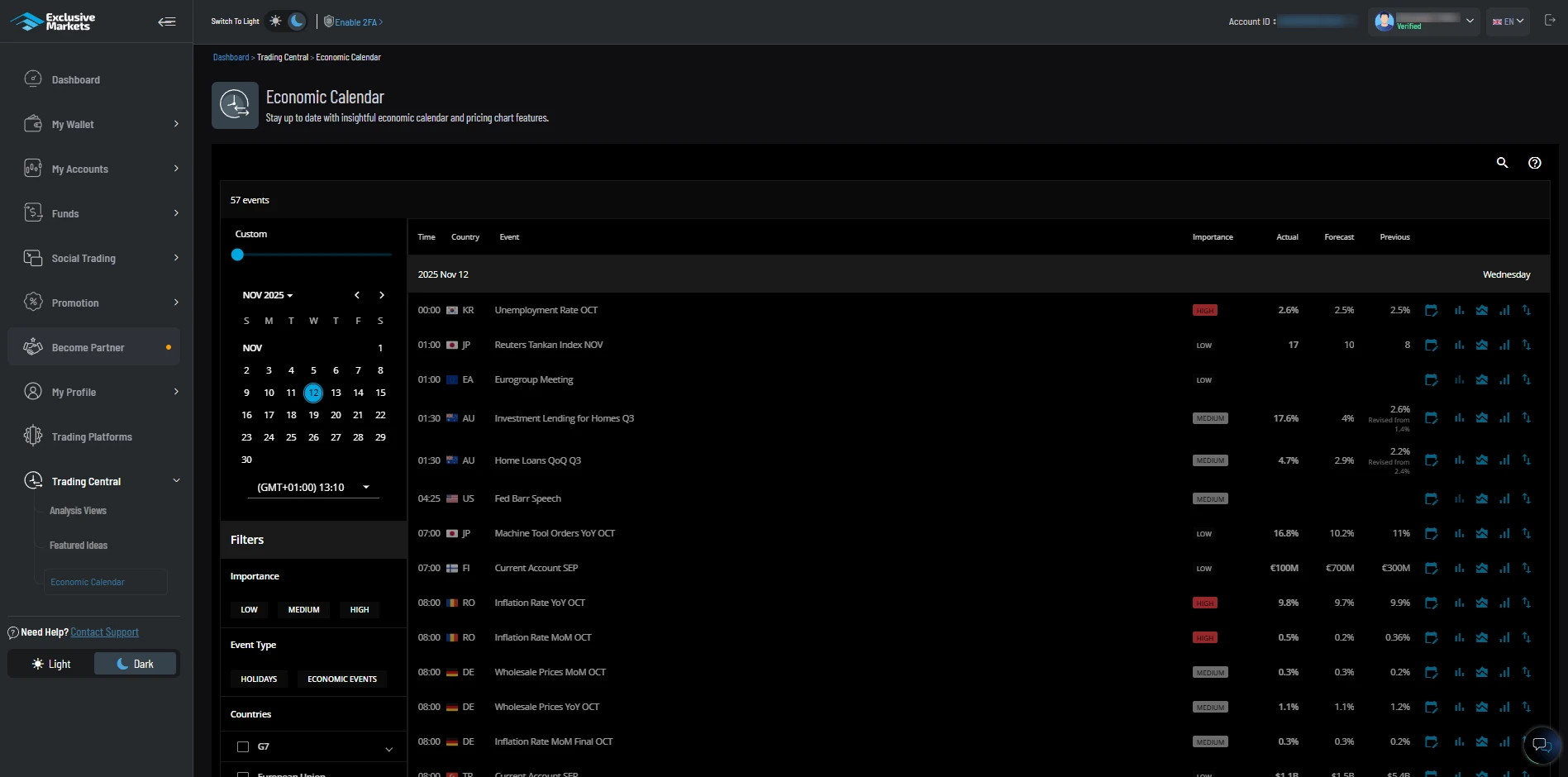

Trading Central's Economic Calendar offers a comprehensive schedule of financial events, providing traders with an intuitive and real-time tool to track global events. The calendar consolidates key announcements, including GDP releases, inflation figures, unemployment data, and interest rate decisions.

For each event, traders can see:

- The scheduled date and time.

- The country and currency affected.

- The importance level (low, medium, or high impact).

- The market consensus or forecast, previous result, and the actual outcome once released.

Key Features of Trading Central’s Economic Calendar

Trading Central's calendar stands out for its usability and depth. Its features include:

-

Real-Time updates

Markets move fast, and outdated information can affect trading decisions. The calendar updates instantly as economic data is released, reflecting the actual figures in real time. This allows traders to explore data and visualise how past economic releases have affected selected currency pairs, bearing in mind that past patterns do not predict future results.

-

Event importance ratings

Not all events have the same impact on the market. Trading Central's Economic Calendar highlights the significance of each announcement with a simple rating system, typically low, medium, or high importance.

For example, a central bank interest rate decision is flagged as a high-impact event, while a secondary data release might carry less weight. These ratings help traders prioritise their attention and prepare for the events most likely to drive volatility.

-

Consensus vs. Actual Comparison

Economic forecasts often set market expectations. The Economic calendar by Trading Central displays the consensus forecast (what analysts expect) alongside the actual result once it's released. Traders can immediately see whether the data exceeded, met, or fell short of expectations, which can influence short-term price reactions, though these moves may not follow past patterns.

For instance, stronger-than-expected employment data can boost a currency, while weaker figures may trigger a sell-off.

-

Historical Data and Patterns

Traders can look back at previous outcomes and examine how markets reacted in the past. However, past performance is not a guarantee of future results.

-

Global Coverage

Forex is a global market, and economic events occur around the clock. Trading Central's calendar spans all major economies, from U.S. Federal Reserve announcements to European Central Bank press conferences, Asian growth reports, and emerging market data releases.

This global scope ensures that traders are aware of developments across multiple time zones, providing them with a broader perspective on what might drive cross-currency flows.

-

User-Friendly Design

The calendar allows traders to filter events by country, currency, date, or event type, ensuring they only see the information most relevant to their strategy.

For example, a trader focused on EUR/USD can filter to view only eurozone and U.S. events, cutting through the noise of less relevant announcements. The clean layout and intuitive navigation make it accessible to both new and experienced traders.

How to use Trading Central’s Economic Calendar for Smarter Trading?

The Economic Calendar by Trading Central not only displays a timetable but also features five interactive elements that help traders analyse, plan, and act effectively.

Here's a detailed look at each:

-

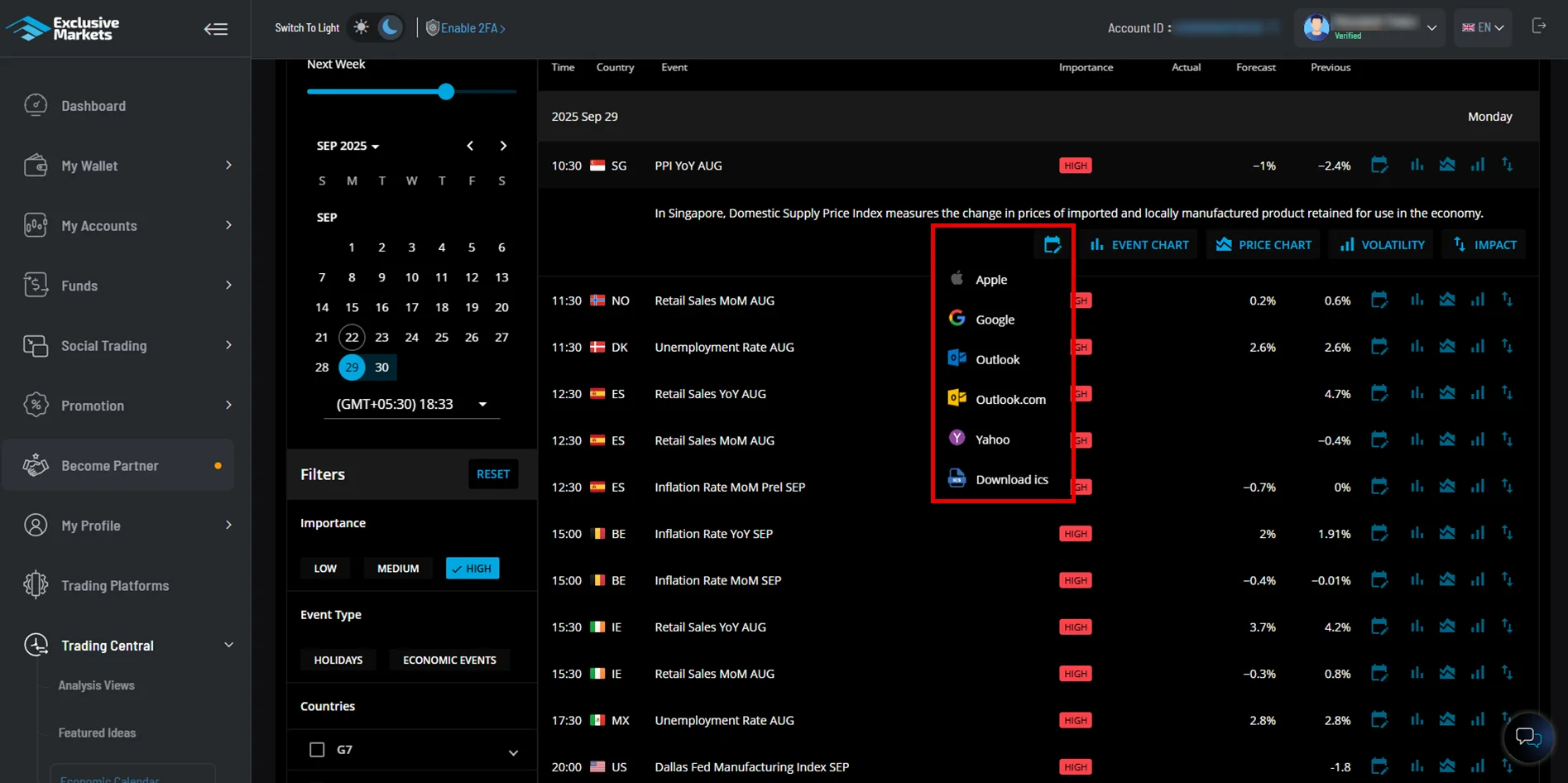

Add to Calendar

The Add to Calendar feature enables traders to integrate key economic events into their personal schedules.

Note: Even with alerts, outcomes and market reactions remain uncertain.

Key Features- Custom notifications: Traders can set alerts for upcoming events, giving them time to review market expectations and adjust positions.

- Personalised tracking: Only select the events relevant to your trading strategy or preferred currency pairs, preventing information overload.

- Planning ahead: By adding events to the calendar, traders can align their trading activity with economic releases, optimising timing for potential opportunities, but caution is advised as these events can lead to rapid and unpredictable price movements.

This feature essentially transforms the Economic Calendar from a static tool into a proactive planning resource.

-

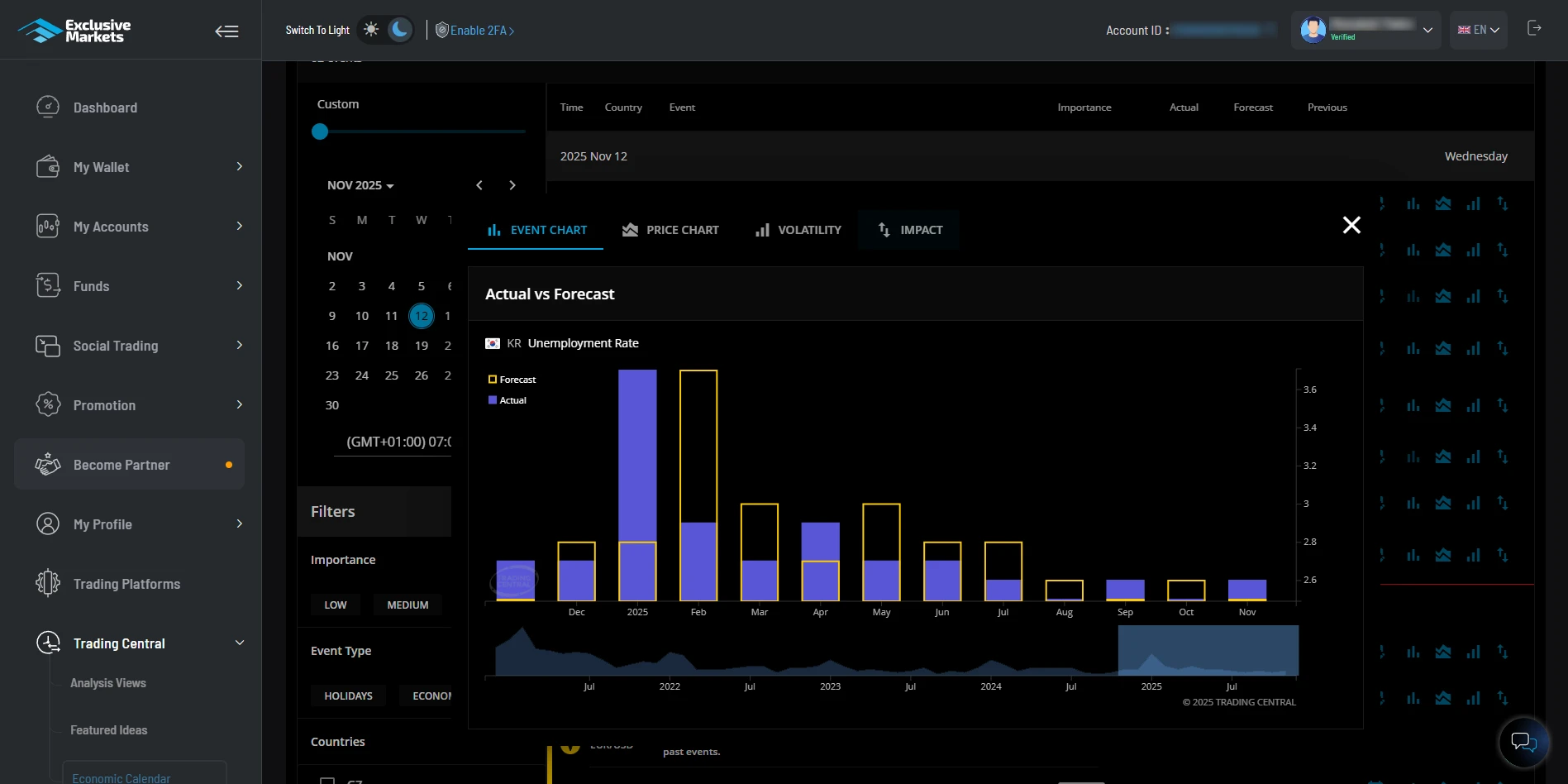

Event Chart

The Event Chart provides a visual representation of the historical market reaction to a specific economic event. It allows traders to understand patterns and trends over time.

Note: Historical reactions do not reliably predict future moves.

Key Features- Historical context: See how past releases of similar events affected currency pairs, including the scale and duration of price movements.

- Event-specific insights: Each chart focuses on a specific event type (e.g., GDP, inflation, employment), providing a visual representation of the historical market reaction to a specific economic event.

- Decision support: By reviewing historical market outcomes, traders can utilise advanced charting features to support evaluation of potential volatility and trends, but such tools do not predict future market direction.

This charting feature may assist in strategy evaluation, but it does not guarantee successful outcomes or profitability.

-

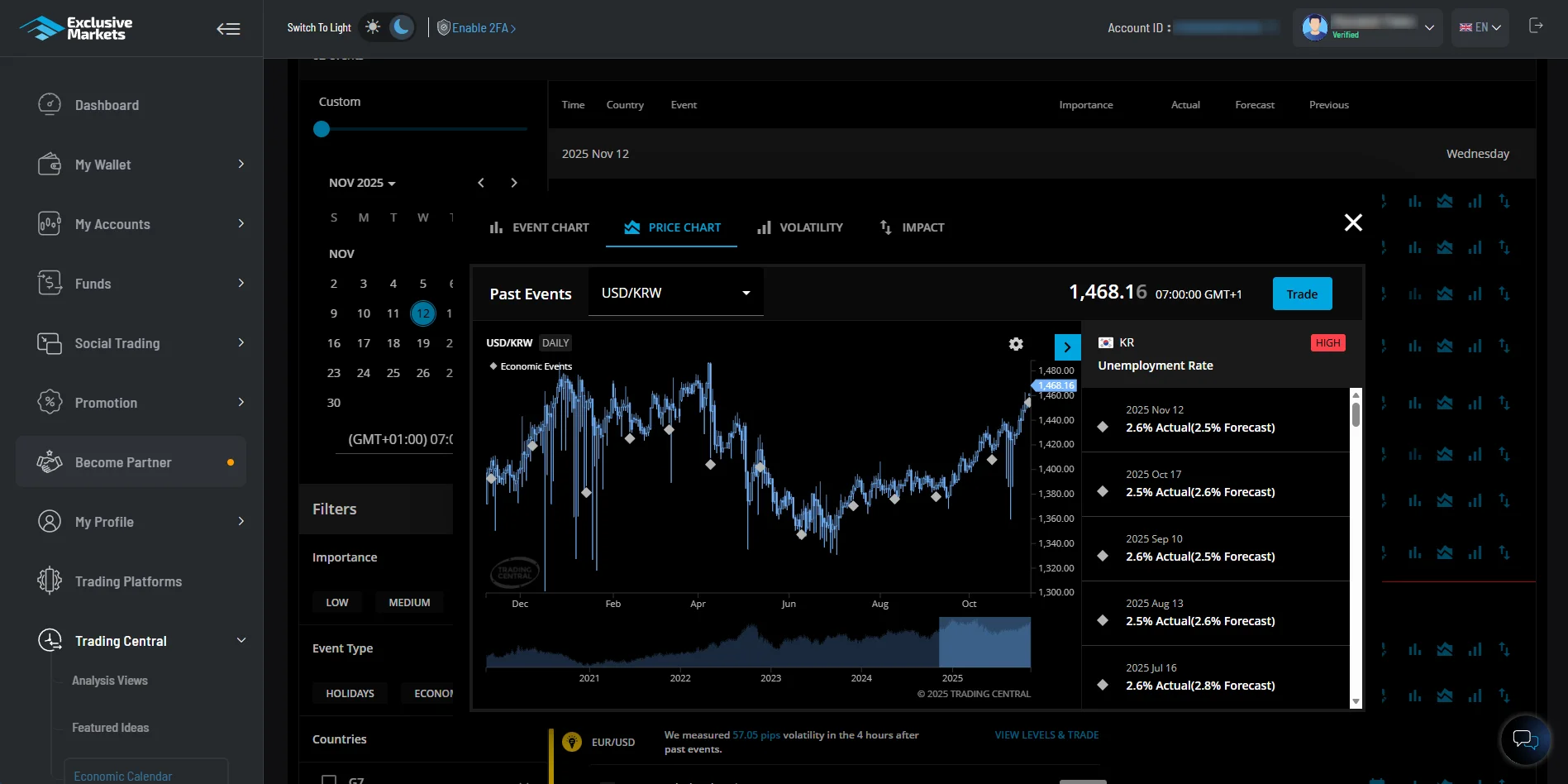

Price Chart

The Price Charts option enables traders to observe the movement of FX pairs surrounding an event. It highlights both short-term and slightly longer-term reactions, helping traders visualise market behaviour.

Key Features- Pre- and post-event tracking: Observe price movement leading up to the announcement and immediately afterwards, providing an overview of the market anticipation versus reaction.

- Entry and exit signals: Identify patterns in price changes around events to support evaluation of potential entry and exit points.

- Currency-specific charts: Traders can select the exact pair they are interested in.

Price charts facilitate the connection between economic data and tangible market reactions, which may support strategy evaluation.

-

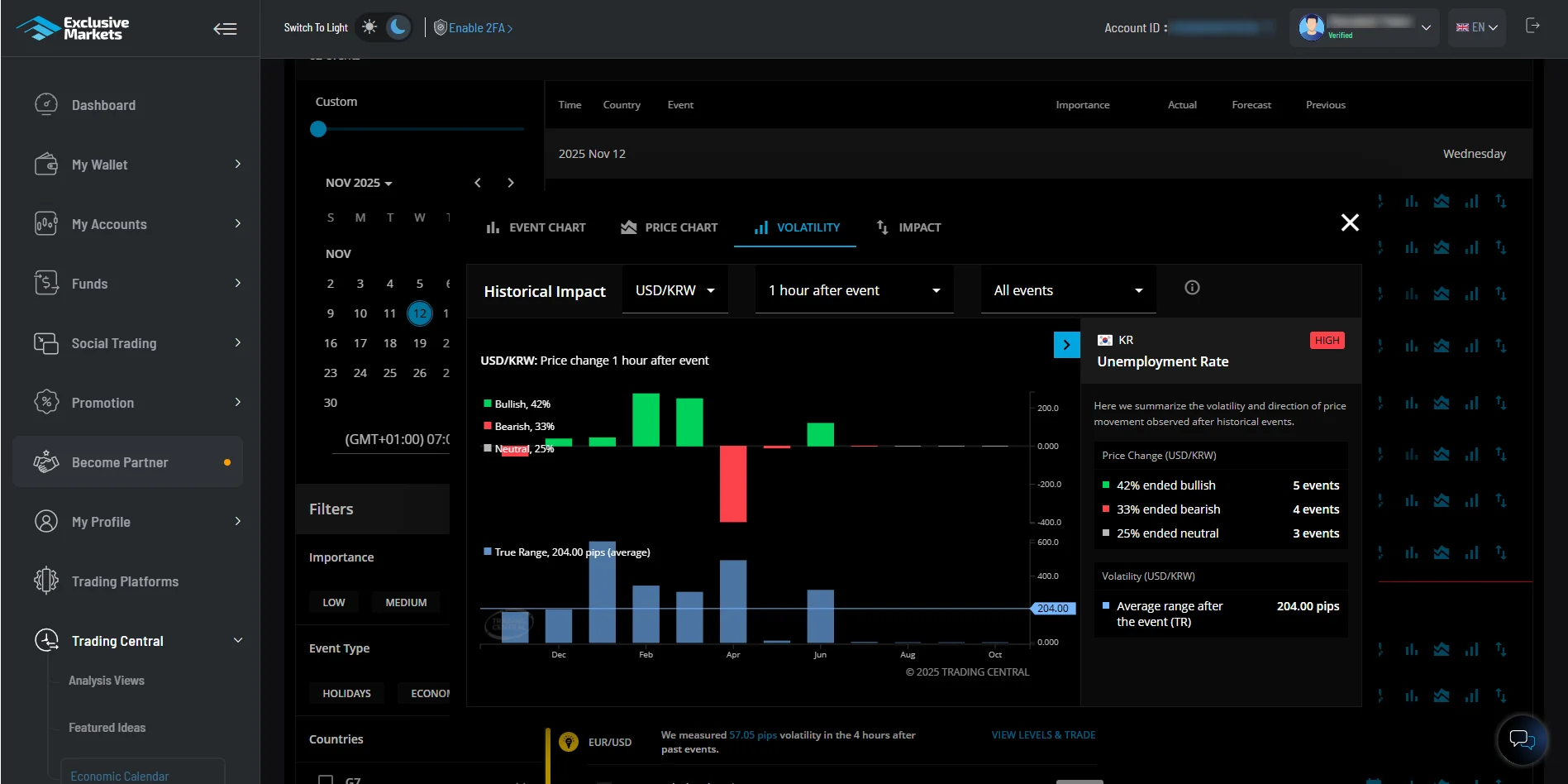

Volatility

The Volatility Tab in Economic Insight helps traders understand the magnitude of market movements following economic releases. Key features include:

Key Features- FX Pair Selection: Traders can choose from 117 different currency pairs.

- Post-Event Observation Periods: Volatility is calculated across multiple time frames, from 5 minutes to 4 hours after the event, assisting traders to observe short-term and medium-term market reactions.

- Event Outcome Filters: Traders can examine results based on whether the actual economic release was above, below, or in line with market expectations.

Once these filters are applied, the calendar displays:

- True Range Pips: Displays historical price movements of the selected FX pair during the observation period. For example, if a 1-hour post-event period is selected, the chart shows the price movement in pips from the event time to one hour later.

- Price Change: Illustrates whether the FX pair moved bullishly or bearishly following the event, providing a visual guide to help assess potential market direction.

- Average True Range Pips: Shows a one-year average of volatility to provide contextual reference.

- Bullish vs. Bearish Ratios: Highlights the historical tendency of the FX pair to move upward or downward in response to similar events.

Analysing these metrics can help traders better understand historical market behaviour and may support evaluation of position sizing, entry, and exit decisions.

-

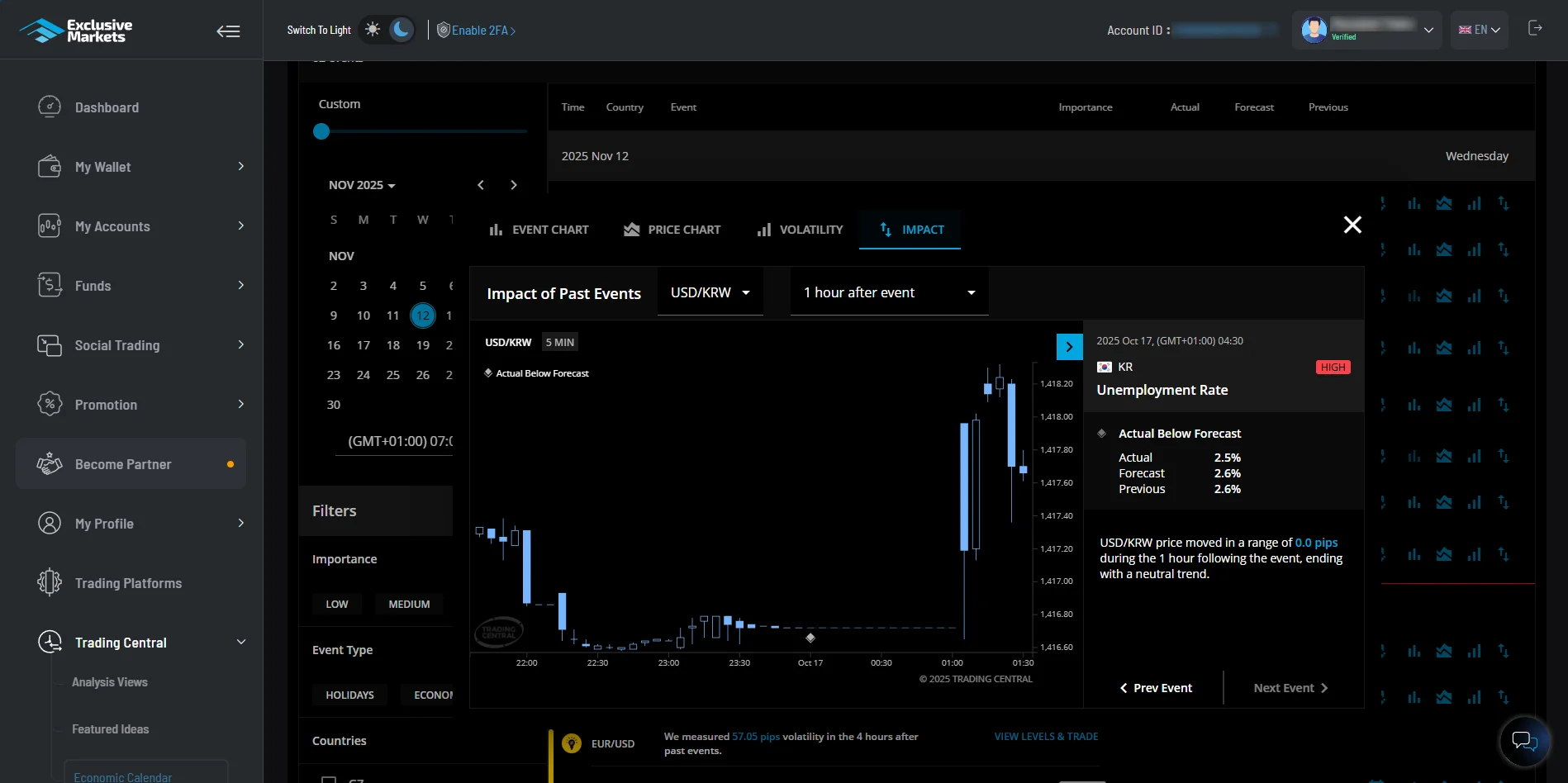

Impact

The Impact tab complements the Volatility option by focusing on the direction of price movement rather than just its magnitude. Traders can select their FX pair and choose a post-event observation period ranging from 15 minutes to 4 hours.

The tab visualises:

- True Range Pips: Shows the volatility of the selected FX pair in pip terms within the chosen timeframe.

- Price Change: Illustrates the directional outcome (bullish or bearish) following the event, displayed in a concise chart.

This feature helps traders understand not only the potential magnitude of price movements but also their likely direction based on historical outcomes.

Access Trading Central’s Economic Calendar with Exclusive Markets

Trading Central's Economic Calendar basic features are freely available on the Exclusive Markets website, allowing visitors to view upcoming global economic events and their potential market significance. This open access ensures that traders, whether new or experienced, can stay informed about scheduled announcements that may influence the forex market.

Here are the steps to gain complete access to the calendar's full functionality through the EXMA trading platform:

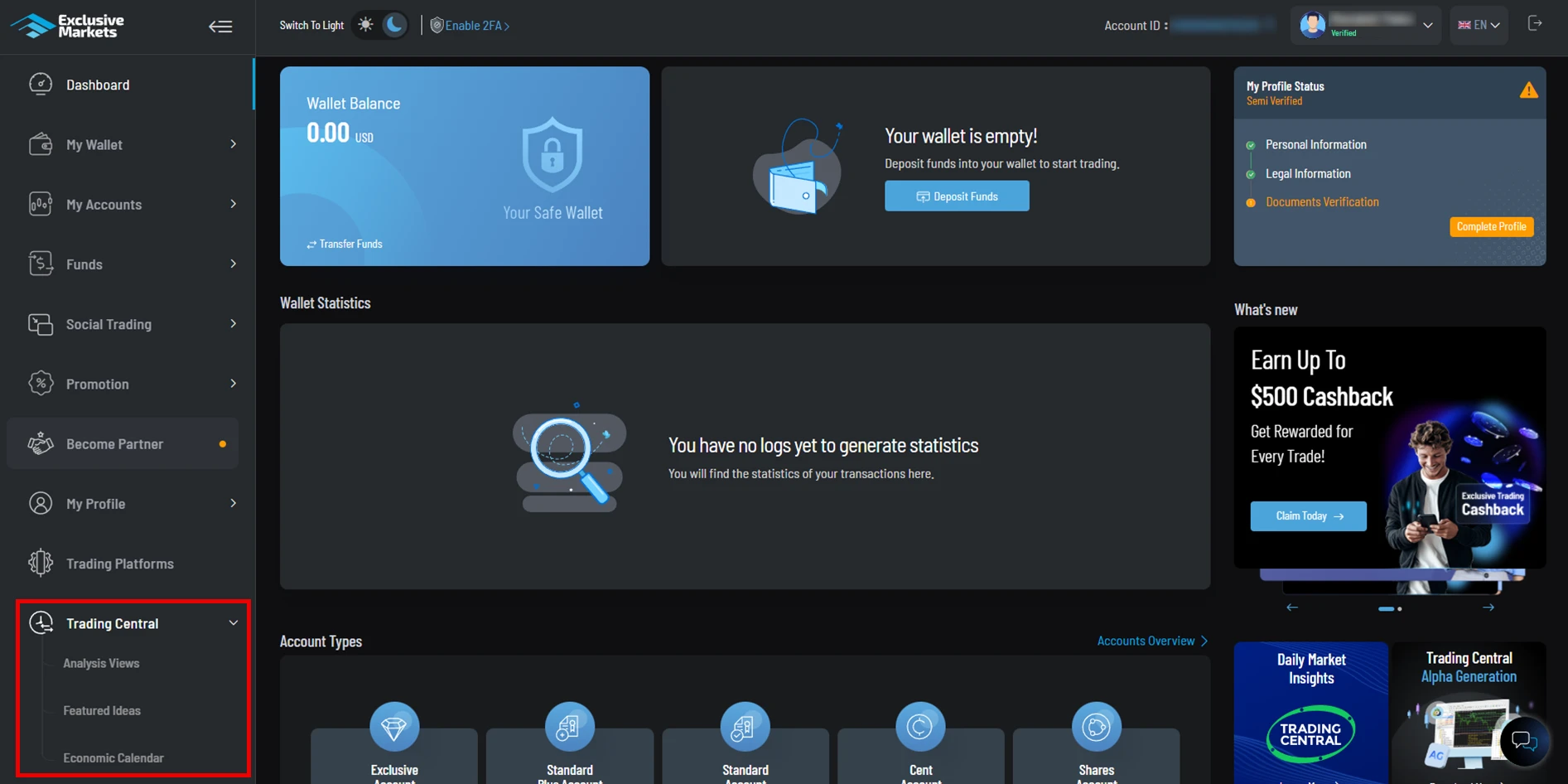

Step 1: Sign Up or Log In

If you're new to Exclusive Markets, visit our official website and complete the registration and relevant verification process by providing basic personal information and verifying your profile.

If you are already a client of Exclusive Markets, simply log in to your client portal using your existing credentials.

Step 2: Access the Client Dashboard

Once logged in, you will be directed to your personal dashboard. This area provides access to your trading account, tools, and resources. On the left-hand side of the dashboard, locate the main navigation panel.

Step 3: Select Trading Central

From the menu, click on the Trading Central option. This will access the suite of analytical tools available to clients. From the available options, select the Economic Calendar.

And that's it! You will now have full access to the calendar's interactive features, including Event charts, Price chart, Volatility analysis, and Impact indicators.

Conclusion

To conclude, staying informed is one of the practical advantages in forex. Knowing when market-moving events are scheduled, how markets have reacted in the past, and which announcements may cause volatility can help traders plan and manage risk more deliberately.

Trading Central’s Economic Calendar is designed to provide a comprehensive and user-friendly view of economic events with real-time updates, importance ratings, consensus vs actual comparisons, historical context, and global coverage.

Beyond the headline schedule, the calendar’s interactive tools allow traders to explore data and visualise how specific economic releases have historically affected selected currency pairs. When used consistently, these features can help incorporate scheduled news into regular trade preparation. For traders navigating the fast-paced forex market, Trading Central’s economic calendar can serve as a valuable tool to support disciplined trading and informed decision-making.

Are you Ready to Explore the World of Trading?

Disclaimer: The information provided on this blog is for educational/informational purposes only and should not be considered financial/investment advice. Trading carries a high level of risk, and you should only trade with capital you can afford to lose. Past performance is not indicative of future results. We do not guarantee the accuracy or completeness of the information presented, and we disclaim all liability for any losses incurred from reliance on this content.

1209

1209 19-11-2025

19-11-2025