Table of Content

- What are Trading Central Featured Ideas?

- How Trading Central’s Featured Ideas Help

- Why Traders Rely on it?

- How to Use Trading Central’s Featured Ideas Effectively?

- Common Misconceptions & Risks to Keep in Mind

- Accessing Featured Ideas with Exclusive Markets

- How to Use Featured Ideas Wisely in Your Trading

- Conclusion

In trading, having the right ideas at the right time can help traders be better prepared, though market conditions remain unpredictable. Markets move fast, and opportunities often vanish just as quickly as they appear.

For many traders, the real challenge isn’t only in spotting a potential trade, but in doing so quickly, with confidence, and backed by data. That’s where Trading Central Featured Ideas come in. A tool that may help traders and investors filter market information, focus on relevant signals, and act with greater structure and clarity.

In this article, we will know about what Trading Central’s Featured Ideas are, how they work, what benefits they offer, and how you can use them intelligently in your trading.

What are Trading Central Featured Ideas?

At its core, Featured Ideas is a product from Trading Central designed to generate actionable trade setups by combining technical chart patterns, fundamental analysis, and advanced filters. It is a premium research and analytics tool designed to give traders and investors data-supported insights, not investment advice or guarantees of performance.

Unlike generic trading tips or one-size-fits-all signals, it provides curated trade setups that combine technical chart patterns, fundamental analysis, and advanced filters. The aim is to help traders focus on well-researched trading setups without spending hours scanning multiple charts and news feeds.

Each idea is accompanied by contextual explanations, annotated charts, and clear entry, stop-loss, and target levels. This means that traders don’t just see a potential trade. Rather, they understand the rationale behind it. Whether you are a beginner looking to learn about technical setups or an experienced trader wanting validated trade opportunities, it provides value for all levels.

Key attributes of Featured Ideas include:

- Multi-factor Trade Ideas: These are not based on a single technical indicator or pattern. For example, a chart pattern like a triangle might be confirmed by a MACD crossover or other technical event, giving more weight of evidence.

- Based on Technical + Fundamental Analysis: Both chart-based technical events and fundamental themes are considered. This helps bridge the gap between pure price action and the macro or news-driven forces that often move markets.

- Educational Analysis: Each idea comes with chart annotations, explanations of which technical events are involved, price targets, and what to watch for. This makes them useful not just as trade suggestions but as learning tools.

- Real-Time Tracking: Interactive charts allow traders to see current price action relative to predefined entry and exit points.

Overall, Trading Central’s Featured Ideas is a tool that promotes informed and structured trading by providing actionable ideas and educational context to help traders use them wisely.

How Trading Central’s Featured Ideas Help

- Continuous Market Scanning: Trading Central scans a wide universe of instruments, including forex pairs, commodities, indices, equities, etc., in real time. It looks for forex chart patterns, technical events, and trend signals and combines them with fundamental triggers. The idea is to detect setups as they form, not after they mature.

- Technical Events & Confirmation: Once a potential pattern is identified (say, a support breakout, reversal pattern, or divergence), other technical tools validate it. These could include indicators like MACD, RSI, trendlines, moving average crossovers, etc. The goal is to reduce potential false signals by requiring confirmation, though no method can eliminate trading risk.

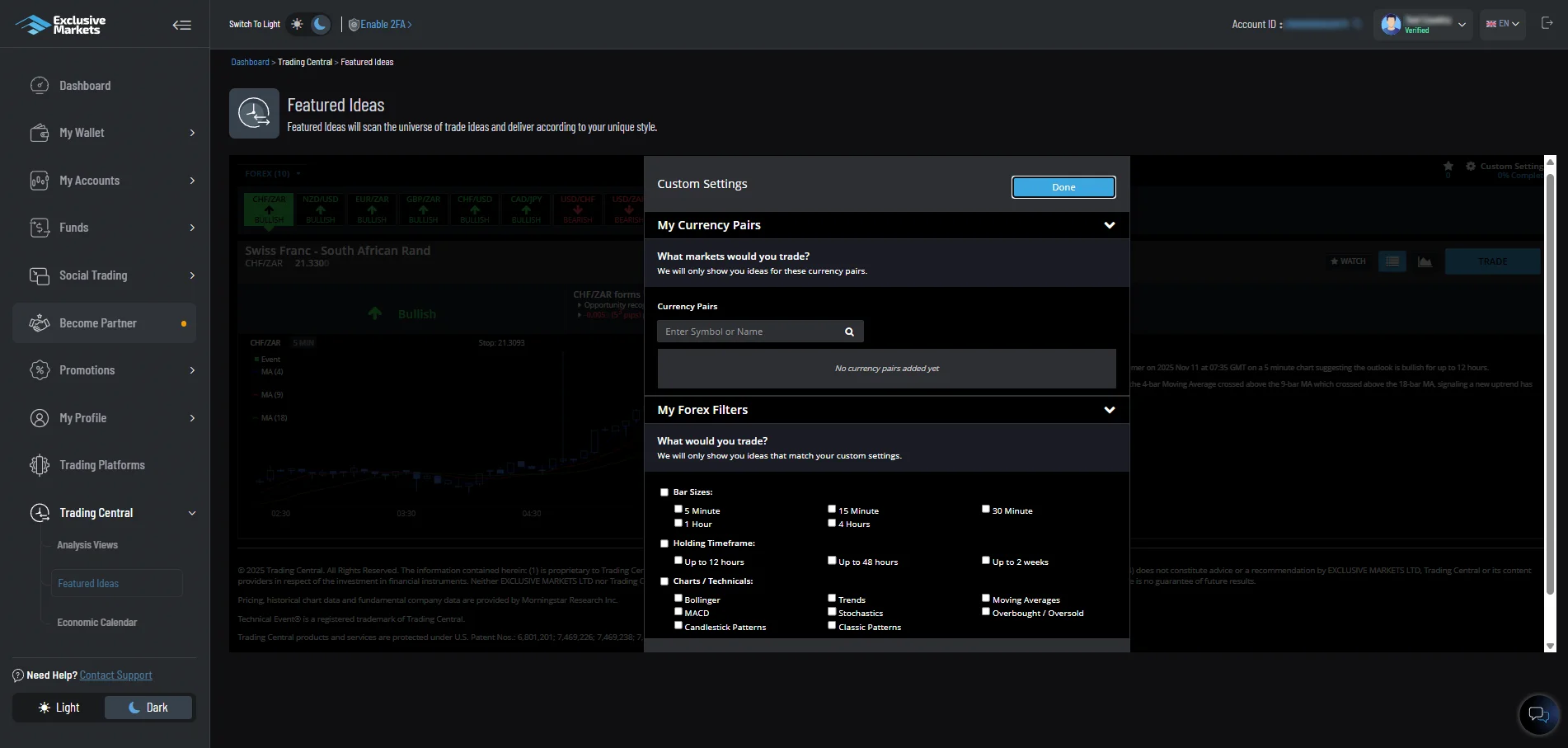

- Filtering & Customisation: Since no two traders are the same, Trading Central’s Featured Ideas allows filtering by style and preferences: currency pairs, chart patterns, bar sizes and holding timeframes, etc. You don’t get bombarded with setups irrelevant to your style.

- Real-Time Charts & Live Tracking: Ideas are shown on live, interactive charts that let you see where the price is relative to defined entry, stop-loss, and target levels. You can track how the instrument moves over time and see when those levels are approached or breached.

- Embedded Education: Alongside the idea itself, there is an analysis too, of which technical events were used, why those events matter, and what targets and risk levels are considered. This helps less experienced traders understand the reasoning rather than blindly following setups.

Why Traders Rely on This?

Why use the Featured Ideas option of Trading Central rather than relying purely on your own charting, news feeds, or trading signals? There are several benefits, especially if you want to trade more intelligently and consistently:

- Clarity and Confidence in Decision-Making: Rather than wondering whether a pattern is valid or struggling to decide if a breakout is real, it provides potential setups supported by technical signals and analysis, helping users make more informed decisions, though market outcomes remain uncertain. They help you make decisions supported by multiple technical signals, but outcomes always depend on market conditions and individual judgment.

- Saved Time & Reduced Noise: Instead of manually scanning dozens of forex charts or watching many indicators, you have ideas already filtered for strength and relevance. This saves time and lets you focus your energy on planning and managing trades effectively.

- Improved Risk Management: Each idea includes risk levels, entry, stop-loss, and target zones. That helps you plan and decide on your position size, set stop losses, and consider risk versus reward rather than jumping in emotionally.

- Educational Value: Seeing annotated charts and reading commentary helps build your trading knowledge. As you follow ideas and see how price action plays out, you gradually internalise what works and what doesn’t, which indicators matter under what conditions, etc.

- Adaptability to Different Styles: Whether you are a swing trader, a day trader, or someone who holds positions longer term, this will allow filtering and customisation so you aren’t overloaded with setups that don’t suit your approach.

These features can support decision-making, but all trades carry risk and outcomes are never guaranteed.

How to Use Trading Central’s Featured Ideas Effectively?

This tool provides curated trading opportunities based on technical analysis. To maximise the benefit, you can customise the settings according to your trading preferences.

-

Customise Your Currency Pairs

The first step involves selecting the currency pairs actively traded. In the “My Currency Pairs” section, the symbol or name of preferred pairs can be entered. This ensures that Trading Central’s Featured Ideas remain relevant to the portfolio and trading strategy.

Focus can be placed on major pairs, such as EUR/USD, or more specialised pairs, like USD/HUF, depending on market interests.

-

Adjust Your Forex Filters

The “My Forex Filters” section allows you to filter ideas based on timeframes, holding periods, and technical indicators. This is crucial for aligning suggestions with your trading style.

- Bar Sizes:

Choose the timeframes you want to analyse. Options include:

- Short-term: 5 Minute, 15 Minute, 30 Minute

- Medium-term: 1 Hour, 4 Hours

Selecting the right bar size helps you focus on trades that match your preferred trading pace, whether scalping or swing trading.

-

Holding Timeframe

Specify how long you typically hold trades:

- Up to 12 hours

- Up to 48 hours

- Up to 2 weeks

This filter ensures that the recommended ideas align with your risk tolerance and trading horizon.

-

Charts / Technical

Select the technical tools you rely on for analysis. Options include:

- Bollinger Bands

- Moving Averages

- MACD

- Stochastics

- Trends

- Overbought / Oversold signals

- Candlestick Patterns

- Classic Patterns

By customising these settings, Trading Central will only show ideas that align with your technical approach, saving you time and enhancing your decision-making.

- Bar Sizes:

-

Review and Execute

Once your settings are applied, the filters will be applied according to your chosen pairs, timeframes, and technical indicators. This enables you to quickly identify data-supported trade setups that align with your strategy, helping translate analysis into potential opportunities.

Common Misconceptions & Risks to Keep in Mind

While Trading Central’s Featured Ideas are powerful, no tool is flawless. Being aware of limitations helps you use them more safely and effectively.

- Not Guaranteed Profitable Trades: Even with multiple confirmations, some trade setups will fail. Markets can move irrationally due to news, unexpected events, or low liquidity.

- Lag in Live Price vs Setup: There can be slight delays or slippage when trying to enter trades, especially around high volatility. Execution risk always exists.

- Over-reliance: Relying entirely on such trade ideas without developing your own market understanding can be risky. If you only copy without understanding, you may struggle when market conditions shift.

- Filter Bias: If your filters are too restrictive, you might miss good opportunities; if too broad, you may get overwhelmed. Finding the right balance is essential.

- Emotional Bias: Even with clear targets and stop-losses, emotions can lead to deviation (moving stop-losses, holding losing trades too long, etc.). Discipline is key.

Accessing Featured Ideas with Exclusive Markets

Trading Central’s Featured Ideas tool offers curated trading opportunities based on in-depth technical analysis. Basic insights are publicly available on the Exclusive Markets website, providing a glimpse into potential trade setups and market trends. This enables traders, whether new or experienced, to stay informed about opportunities that could influence the forex market.

To unlock the full functionality through our trading platform, the following steps are required:

Step 1: Register or Log In

New clients can visit the Exclusive Markets website to complete the registration process, including profile verification.

Existing clients can simply log in using their established credentials to access their accounts.

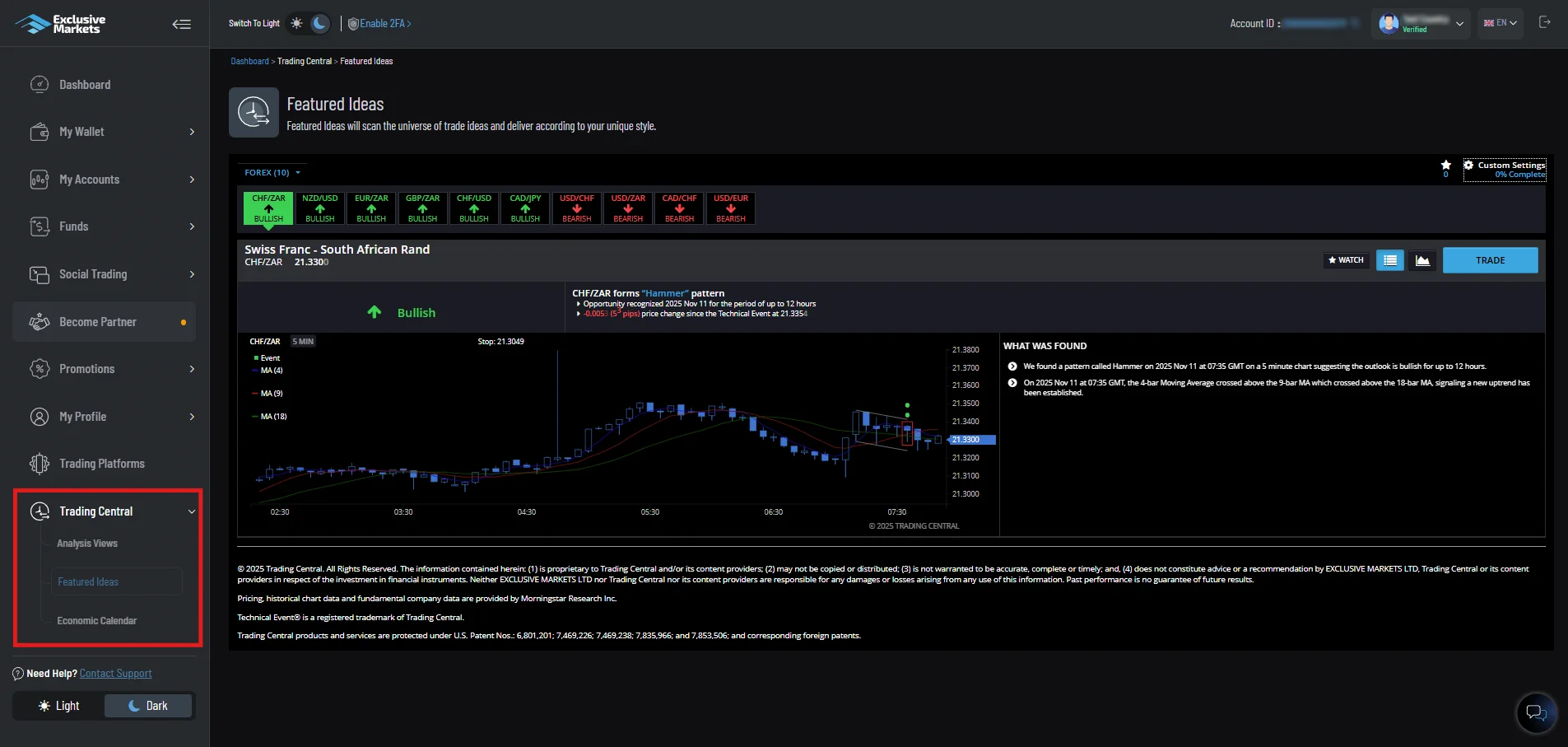

Step 2: Navigate to the Client Dashboard

Upon logging in, the client dashboard appears, providing access to accounts, tools, and resources. The main navigation panel on the left-hand side of the dashboard serves as the gateway to all available features.

Step 3: Access Trading Central and Featured Ideas

From the navigation menu, the Trading Central section should be selected. Within this section, choosing Featured Ideas opens the full suite of curated trade setups.

Once accessed, clients gain the ability to explore interactive features, including trade signals, technical charts, trend analyses, and probability indicators. This comprehensive access may support informed and data-driven decisions, helping traders evaluate potential opportunities, though trading outcomes remain uncertain and involve risk.

How to Use Featured Ideas Wisely in Your Trading

Success in utilising Featured Ideas provided by Trading Central often hinges on strategy, discipline, and alignment with your own trading profile. Here are some tips:

- Match Setup to Your Timeframe: Don’t take a very short-term idea if you’re holding trades for weeks. Use ideas that align with how long you want to keep the position.

- Use Proper Risk-Reward Ratios: Always calculate whether the target justifies the risk. If the target is only slightly above your entry, but the stop-loss is far, it may not be worth it.

- Combine with Fundamental Awareness: Even though many ideas have fundamental elements, always keep track of upcoming economic events, earnings reports, and geopolitical risk. A strong idea in a chart may get wiped out by bad news.

- Be Selective: Pick the ones you are most convinced about, or that match your strategy. Fewer high-quality trades often beat many weak ones.

- Use Alerts & Notifications: If possible, set up alerts for when the price approaches entry, or breaks support/resistance levels. This helps ensure you don’t miss setups due to being away from charts.

- Review Performance: After a period (say a month), check how many ideas you followed, how many hits vs misses, what went well, and what didn’t. Use that to refine which types of ideas work best for you.

Conclusion

Trading Central’s Featured Ideas are a high-value tool for traders who want clarity, informed setups, and educational value, not just raw signals. They combine technical patterns, confirmation events, and market context into trade ideas that you can review, evaluate, and consider as part of your broader analysis, not as financial advice. Used thoughtfully, they can help you focus your analysis and make more informed trading decisions.

If you align them with your strategy, use good risk management, and keep learning, your trading can become more consistent and less stressful.

Are you Ready to Explore the World of Trading?

Disclaimer: The information provided on this blog is for educational/informational purposes only and should not be considered financial/investment advice. Trading carries a high level of risk, and you should only trade with capital you can afford to lose. Past performance is not indicative of future results. We do not guarantee the accuracy or completeness of the information presented, and we disclaim all liability for any losses incurred from reliance on this content.

732

732 21-11-2025

21-11-2025